In a boon for riders, the MTA is ending 2021 much as it began the year: by delaying a planned fare hike for at least six months and putting off planned service cuts indefinitely. The news, first announced by Gov. Kathy Hochul and later clarified by MTA Acting Chair and CEO Janno Lieber, will come as welcome news as subway riders continue to return to the system and came about due to various federal COVID relief bills.

Hochul first announced the pause on Monday before flying to DC to joint President Joe Biden for the signing ceremony of the infrastructure bill, and she made it sound as though the BIF was the cause of the pause. She said:

We’ve done the numbers. And as a result of the money we’ll be receiving from the president signing the bill today, I’ll be witnessing this. We anticipate that there’ll be no fare hikes for the MTA. So therefore, those of you who are commuters on the MTA and have been anxious about how much this is going to go up, especially in this era of inflation, when it just seems when you’re just trying to get your head above water and come out from under a long dark period of the pandemic, and you might get a little bit more money in your paycheck, that the cost of living from gasoline to the cost of turkeys in another week and a half, this is really affecting people’s ability to just put food on their table. And I’m really excited to say that we will not have to raise the fairs or have any service cuts. The service cuts that were planned for 2023 and 2024 are now off the table for MTA commuters.

The MTA later clarified that the delay in any fare hikes and the indefinite postponement of service cuts is due more to COVID relief bills rather than the recent infrastructure deal, but either way, riders are the ones who stand to benefit. In comments on Monday to reporters during the MTA Board committee meetings, Lieber added context to Hochul’s promise. The MTA will delay any consideration of fare hikes for at least six months, if not longer, and the service cuts are no longer part of the agency’s budget projections. “We are not planning to reinstitute those hearings and that process,” Lieber said of the fare hikes, once planned for 2021. “For now, fare hikes are off the table; service cuts are off the table…We do not want to discourage people from coming back by raising the fares.”

For the budget wonks among us, Lieber explained how the various COVID and infrastructure bills allowed the MTA to halt these harmful cost increases and service reductions. Effectively, since the BIF enables the MTA to receive more money directly, the agency does not have to borrow as much to fund its capital plan. The debt payments associated with capital borrowing are applied to the operating budget so more direct funding means less deficit funding. Additionally, a few days ago, New York, New Jersey and Connecticut finally reached agreement on COVID relief funding for transit, and the MTA no longer has to borrow against future revenues to ensure cash flow remains consistent. Thus, the agency had the financial leeway to hold off on fare hikes for now and defer service cuts for the next few years.

Reading the political tea leaves allows us to catch a glimpse of when the agency may reconsider fare hikes, and it’s very unlikely to be during 2022. Lieber told reporters that fare hikes could be implemented “in theory” over the summer or in October, but that would align fare hikes with votes in a hotly-contested gubernatorial primary or general election next year. Hochul, fighting for a term of her own, is not going to permit the MTA to raise fares before she secures her seat, and Lieber and the MTA are more than willing to go along with their boss’ plan. “We are,” Lieber said, “taking fare hikes off the table for at least six months and maybe well beyond that.”

What happens beyond the election in 2022 is anyone’s guess. MTA leadership has not been shy in noting that the COVID relief money is driving this policy. “The deficit is looming because of COVID when the Washington money runs out,” Lieber said, and he wants the legislature to come up with a funding plan that isn’t as heavily reliant on ridership as the MTA’s current projections. After all, COVID took a huge bite out of ridership, and the MTA — which must balance its budget by law — doesn’t want to cut service or raise fares as it works to rebuild its rider base. Currently, weekday ridership is around 55-58% of what it was before the pandemic, and the agency does not expect another big bump until early January when more commuters return to their offices. Thus, ridership revenue will continue to lag as it has since March 2020, and the state, the MTA says, should find more equitable ways to fund transit that do not fall so heavily on the wallets of passengers.

That’s a discussion that will have to unfold over the next few months and years. For now, as the MTA freezes fares, I ask is this good policy? And is this good politics? By freezing fares, the MTA is foregoing approximately $200 million in additional revenue that could be used to further pay down past debts or finance operations. As the money isn’t a 1-for-1 replacement from the feds, the MTA, through a decision by the Governor, is foregoing this added revenue. In a vacuum, this may not be great policy, but it’s very good politics.

While you or I may ride the subways regularly, the MTA still must work to convince New Yorkers to come back to transit. Those missing 40% of riders — which can amount to 2 or 2.5 million swipes every day — won’t come back by themselves, and the MTA will have to work for it. As many riders remain essential workers who never left the system and others look at various options, the MTA is wise to keep fares down, as they were earlier this year when they delayed the fare hike in January. The agency isn’t about to reduce fares as some cities have done, but not raising the rates at a time when service isn’t better and riders need to have faith in the subway is good politics.

It’s also good personal politics for a politician to avoid fare raises during an election year. While the MTA was founded to remove politics from fare decisions, we saw during Andrew Cuomo’s reign just how easy it is to politicize transit. If Hochul wants to do us all a favor by keeping fares where they are for another year, I won’t look this gift horse any more closely in the mouth than I already have.

And so the fares remain the same. More importantly, the service cuts, which would exacerbate a death spiral, remain off the table, and the MTA continues along, bending to the will of the governor who is in control and allow the public some measure of relief as New York continues its late-COVID rebound.

Amidst an ongoing pandemic that has decimated the economy and reduced daily transit ridership to essential workers traveling to keep the city and themselves afloat, the MTA Board has tabled talks of a fare hike, agency officials confirmed on Monday. The decision comes after months of public pressure by both elected officials and transit advocates, and it marks the first time since biennial fare hikes began in 2010 that the MTA Board — and by extension, the governor — has opted to cancel or at least postpone a fare hike.

Amidst an ongoing pandemic that has decimated the economy and reduced daily transit ridership to essential workers traveling to keep the city and themselves afloat, the MTA Board has tabled talks of a fare hike, agency officials confirmed on Monday. The decision comes after months of public pressure by both elected officials and transit advocates, and it marks the first time since biennial fare hikes began in 2010 that the MTA Board — and by extension, the governor — has opted to cancel or at least postpone a fare hike.

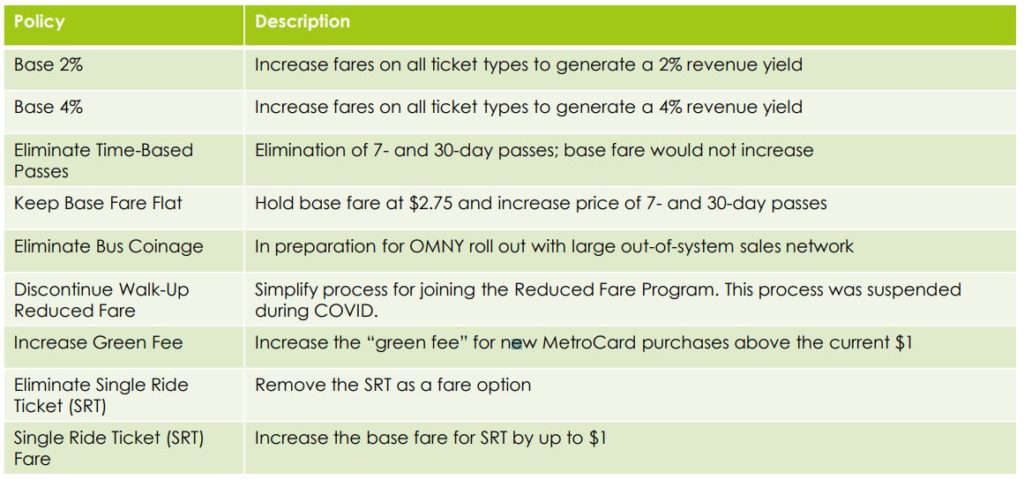

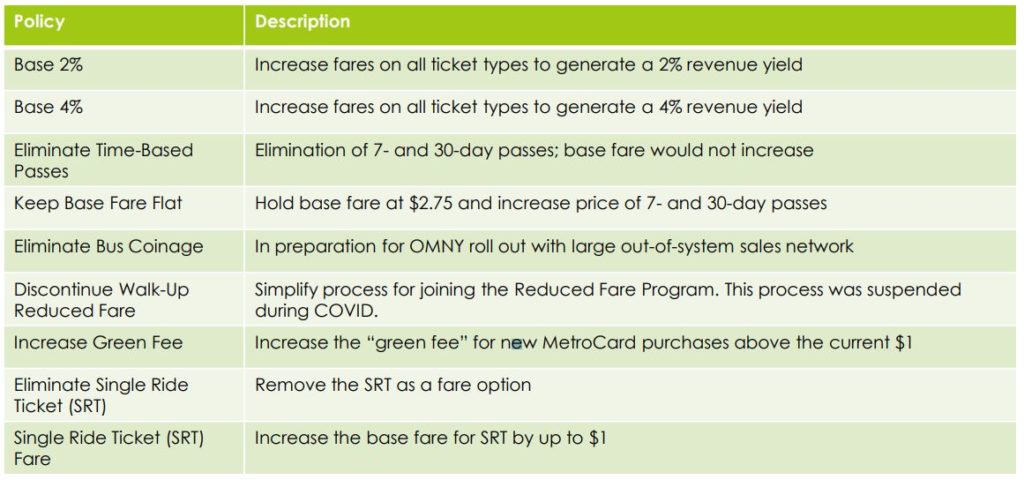

New York City’s transit fares are on the rise again next year. In what was nothing more than a formality, the MTA this week confirmed that the agency’s policy of small biennial fare hikes will continue at least through 2019 and that the fares will rise in March of 2017 by an amount designed to increase fare revenue by around 4 percent. Riders aren’t happy, but if the MTA can offer a carrot to this ugly stick of increased transit costs, it’s a pill New Yorkers will resignedly swallow.

New York City’s transit fares are on the rise again next year. In what was nothing more than a formality, the MTA this week confirmed that the agency’s policy of small biennial fare hikes will continue at least through 2019 and that the fares will rise in March of 2017 by an amount designed to increase fare revenue by around 4 percent. Riders aren’t happy, but if the MTA can offer a carrot to this ugly stick of increased transit costs, it’s a pill New Yorkers will resignedly swallow.