With a sealed token slot, a MetroCard swiper and an OMNY reader, our Frankenstein turnstiles showcase the last three generations of subway fare payment technology. (Photo by Benjamin Kabak. See more on Instagram.)

It’s hard to believe the MetroCard is only 26 years old. It seems as though the MTA has been talking about replacing the now-iconic blue and gold cards for nearly half its life, but that’s what happens when plans for a fare payment system based on a magnetic strip first proposed in 1983 take a decade to become a reality. By the time everyone is using the thing, it’s already outdated.

Now, though, the end is truly near, and the MetroCard’s killer, a tap-and-go system called OMNY and developed by Cubic based off of London’s current contactless fare payment technology, officially launched on Friday. “The Metrocard has served New York well for the last 25 years but its time has come,” MTA CEO and Chairman Pat Foye said during Friday’s press conference.

The path to get to a tap-and-go system for New York City was a bit of a torturous one, and the city has yet again seen its global competitors pass it by. London, for instance, adopted its own proprietary tap-and-go card in 2003 and has been accepting contactless cards on the Underground since late 2014. New York City, meanwhile, rolled out the MetroCard when magnetic strips were nearly obsolete and spent much of the last two decades spinnings its wheel. A brief contactless pilot around 2006 went nowhere as American payment card market wasn’t in line with the MTA’s needs, and a concerted effort to replace the Metrocard by 2012 floundered spectacularly amidst a bureaucratic morass. The Cubic solution came into view in mid-2016 but not until after a short delay in the project due to political in-fighting over the MTA’s capital plan. It’s never easy in New York City.

But on Friday, New Yorkers could finally tap and go. The new system — branded as One Metro New York since it will be used throughout the region — launched with a 16-station pilot on all stations along the Lexington Ave. line between Grand Central and Atlantic Ave. and on all Staten Island buses. For now, and as the system rolls out citywide over the next 18 months, only those riders paying full fare will be able to use the contactless option as OMNY won’t be ready for time-based cards — 7- or 30-day unlimiteds — until 2021 at the earliest.

Still, even though over 50% of riders can’t use their preferred travel passes on the system, MTA officials were excited about the debut. “We’ve spent years designing, developing and testing OMNY and we’re going to spend the next several months with the help of all New Yorkers to ensure all systems are working as we designed them,” Foye said.

OMNY doesn’t come cheap. Cubic’s contract includes a budget of nearly $650 million as workers need to outfit every turnstile and bus in the city with the new technology and develop and build new fare payment card machines. But the MTA expects to earn back this expense by significantly lowering the amount of money is spends on fare collection. With higher maintenance costs and a technology wearing down, even with the steep cost, the MTA believed it had to upgrade. “We really didn’t have a choice but to replace the Metrocard,” Foye said.

Under the OMNY rollout schedule, all buses and subways will have readers by the end of 2020, but the MetroCard will live on until 2023. (Click to enlarge)

Despite the hoopla surrounding Friday’s launch, New Yorkers still have a lot of questions about OMNY, and it’s clear in the responses I’ve received that people still aren’t quite sure what is happening and what the new fare payment system will be. I’ll try to explain. OMNY is a contactless, open loop payment system that will fully replace the closed-loop MetroCard. This means riders can pay with a variety of options including contactless-enabled debit and credit cards, Apple Pay on their iPhones (or an Apple Watch), Google Pay or any similar system or, when the rollout is complete, riders who are unbanked, don’t have credit or debit cards or wish to pay with cash, will be able to purchase an OMNY card, as they do now.

“At every phase of this,” Foye explained, “New Yorkers will be able to use Metrocards (or OMNY cards) or cash. People who do not have bank accounts or credit cards are going to continue as they can today use cash to buy a MetroCard or ultimately an OMNY card.”

For those of us who use time-based monthly or weekly cards, the MTA will at first establish an account-based system via OMNY where riders can purchase time. I’d imagine WageWorks will rely on a similar system too, but the pre-tax benefits system hasn’t yet determined how its offerings will work with the new system.

The MTA will eventually offer a proprietary OMNY card for those who want to pay in cash or do not have bank cards. Cash will always be an option, MTA officials said on Friday.

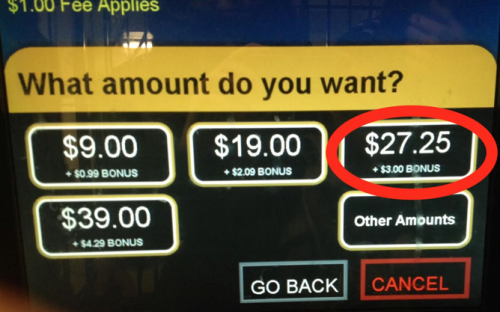

Eventually, too, the MTA can institute fare capping as Transport for London does in London. This system essentially converts pay-per-ride outlays to time-based caps after a rider pays for a certain number of rides in a certain period of time. After a rider reaches the cap, the rest of the rides in that time period are essentially free, and capping is a huge benefit for those riders who can’t afford to layout nearly $130 in advance for a monthly card or who wind up riding more frequently in a certain period of time than they anticipated. Any capping fare structure is still at least 3 or 4 years down the road, if not more.

As to payment processing, the transaction is seamless and without the potential for swipe errors that currently plague MetroCard users. Payment card taps are nearly instantaneous, and Apple’s new Express Transit Pay feature means a user doesn’t even have to unlock the phone or pre-validate use of the card to pay.

That doesn’t mean the initial pilot will feature smooth contactless transactions each time. During Friday’s press conference, Al Putre, the MTA’s executive director of new fare payment technology, spoke about the breadth of credit cards available throughout the world, a concern also raised by the MTA’s independent engineering consultant during a recent Board review of the project. There are, Putre noted, over 350 payment cards manufactured all over the world, and each have their own chipsets. “We’ve configured this system to match as many of them as we can find,” he said. “However, until we introduce them into the ecosystem and we run this pilot, we can’t be certain we’ve hit them. So hopefully with this process, we’ll identify any cards that need to be configured, and we’ll be good to go.”

(Interestingly, the MTA’s decision to implement a contactless fare payment technology finally pushed the U.S. bank card industry to embrace contactless as a standard. The MTA spent a lot of time pressuring and working with these companies to bring contactless to the masses, and the industry expects these cards to spread rapidly as OMNY comes online. Bloomberg’s Jennifer Surane wrote an insightful overview on the behind-the-scenes negotiations that went into bringing OMNY to reality.)

As to concerns over security, the MTA noted the technology adheres to payment industry requirements and vowed to continue its current practices. “It’s the same process as someone going to a MetroCard vending machine with a credit card,” Foye said. “We are not going to sell, lease or do anything with any customer’s information. That’s our policy today and that’s going to continue to be our policy.”

I’m sure I’m not answering some questions a lot of New Yorkers may have, and I’m hoping to schedule a chat or mailbag on OMNY along with a few more Q-and-A type-posts. In the meantime, the MTA’s OMNY website discusses the future to come and includes the rollout schedule. The early returns though are promising. In fact, for its first full day of use on Saturday, OMNY saw 6100 taps, far more than the MTA had expected, and 80 percent of those were via phones, Vin Barone of amNew York reported on Sunday. “We’re thrilled,” Putre said, “New Yorkers are adopting OMNY even quicker than expected, and that the first several days have gone so well. The more that people use the system the easier it will be for us to learn what’s working and what isn’t, ensuring that New Yorkers will get the system they deserve — one that saves them time and hassle as they go about their day.”

Ultimately, then, this is the true end of the MetroCard. We’ll be stuck with it until 2023, but the 1990s’ hot new thing that somehow became a familiar New York icon in short order is on the way out. The MetroCard is dead; long live the MetroCard.